Penticton Housing Market Update – January 2026

January brought a cautious start to the new year, with numbers that reflect both typical seasonal patterns and continued uncertainty in the marketplace. While some indicators show stability, the overall picture suggests buyers and sellers alike are taking a “wait and see” approach as 2026 unfolds.

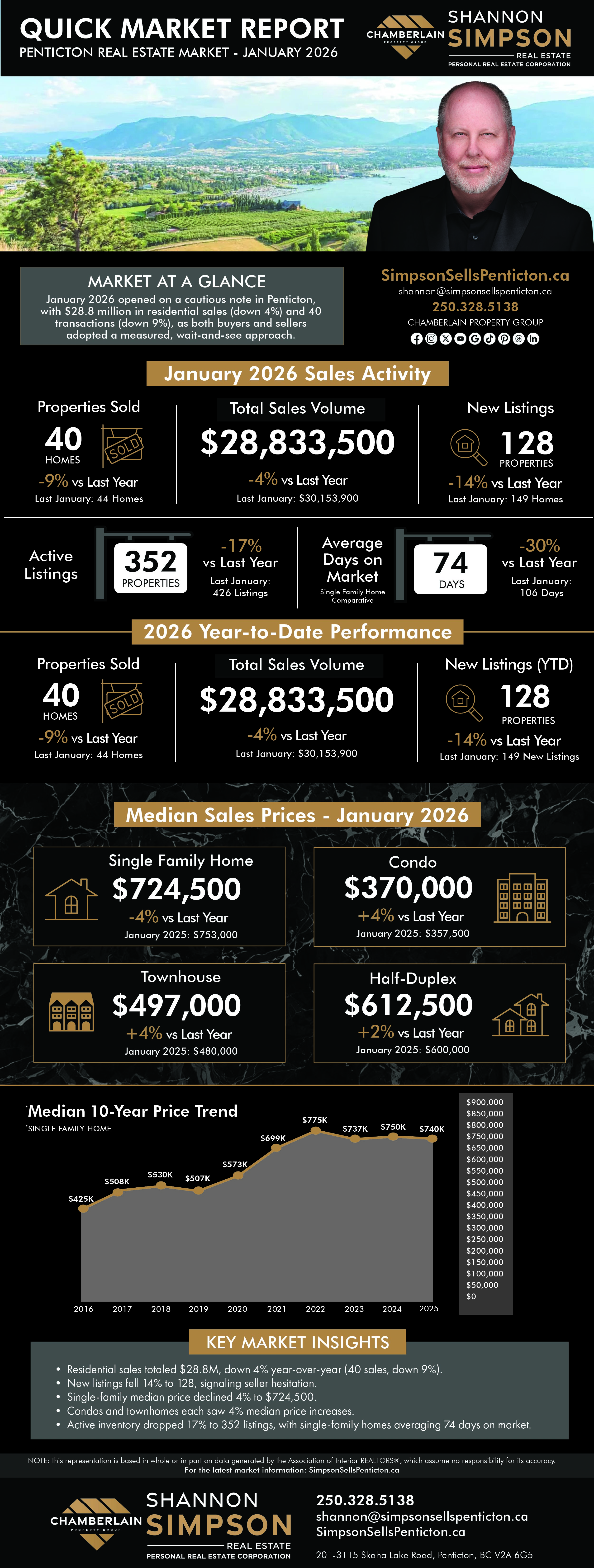

Residential sales for the month reached $28.8 million, down 4% from January 2025. This represents 40 sales (down 9%), while 128 new listings came to market – down 14% from last year’s 149. These declines tell a familiar story: January is traditionally a quiet month, but the drop in new listings suggests many sellers are holding back, waiting to see how the year develops before committing to the market.

The year-to-date comparison shows we’re starting 2026 on a softer note than 2025. With both sales and new listings down from last year’s opening month, the market is clearly operating with more caution than optimism.

Prices and Property Types:

- Single‑Family homes: Median price sits at $724,500, down 4% from last year’s $753,000. The immediate comparison shows continued softening in this segment.

- Condos: Median price at $370,000, up 4% from $357,500. This uptick provides a small bright spot, though it’s worth noting this follows months of downward pressure in the condo market.

- Townhouses: At $497,000, up 4% from $480,000. This segment continues to show relative stability compared to other property types.

- Half Duplexes: Rose to $612,500, up 2% from $600,000. The modest gain suggests this market is holding steady without dramatic movement in either direction.

The pricing landscape remains mixed. While attached housing shows some upward movement, single-family homes – which typically drive market sentiment – continue to adjust downward. This divergence creates uncertainty about which direction the broader market is heading.

Market Pace and Inventory:

Single-family homes averaged 74 days on market in January, down from 106 days last year. While this might appear positive, it’s important to be cautious about reading too much into January’s numbers given the low transaction volume. Faster sales could indicate well-priced properties moving, or it could simply reflect statistical variation in a small sample size.

Active inventory stands at 352 listings, down 17% from 426 listings last year. Lower inventory typically favors sellers, but in this context, it may also reflect hesitation from potential sellers who are uncertain about current market conditions and hesitant to list.

What This Means for You:

- For sellers: January’s numbers suggest this isn’t the time for optimistic pricing. The market remains selective, and buyers have options. If you’re planning to sell, realistic pricing and strong presentation will be essential to stand out in a market where buyers are being cautious with their decisions.

- For buyers: You have time to be thoughtful. While inventory is lower than last year, transaction volumes are also down, suggesting you’re not competing against a rush of other buyers. Use this period to understand value in different segments and be ready to move when you find the right opportunity at the right price.

- For everyone: January has given us limited information to work with. One month doesn’t make a trend, and there are too many unknowns ahead – from interest rate decisions to broader economic factors to draw confident conclusions about how 2026 will unfold.

My Take:

January’s numbers don’t tell us much we didn’t already expect: the market started the year quietly, and uncertainty continues to influence both buyer and seller behavior. The 9% decline in sales isn’t alarming for a January, but it doesn’t inspire confidence either.

What concerns me more than the sales numbers is the 14% drop in new listings. When sellers hold back, it’s usually because they’re uncertain about achieving their desired price, or they’re waiting to see if conditions improve. Combined with softening single-family prices, this suggests the market hasn’t found its footing yet for 2026.

The mixed price signals across property types make it difficult to draw clear conclusions. Condos and Townhouses showing gains while Single-Family Homes soften creates confusion about market direction rather than clarity. For buyers and sellers trying to make decisions, this lack of clear trend is frustrating.

The faster days on market statistic – 74 days vs. 106 days – needs context. With only 40 sales in the month, this could easily be influenced by a handful of well-priced properties that moved quickly, rather than representing a genuine shift in market pace. I’d want to see this trend continue for a few more months before concluding that buyers are becoming more decisive.

As we move through February and March, we’ll get better information about how 2026 is really shaping up. Traditionally, spring brings more inventory and more buyer activity, which will give us a clearer picture of supply and demand dynamics. Until then, my advice is to remain realistic about current conditions and avoid making major decisions based on January’s limited data.January has given us a starting point, but not much more than that. The market remains in a holding pattern, and it will take several more months of data before we understand whether 2026 will build on 2025’s stability or chart a different course.

Remember, if you have any questions, I’m always here to help you MAKE SENSE OF IT ALL!